INTRODUCTION

We reported previously on the reduction in the personal injury discount rate from 2.5% to -0.75%, which took effect from 20 March 2017. This was a much larger decrease than was anticipated by the insurance industry, with predictions initially ranging from 0.5-1.5%.

At the time, the then Lord Chancellor, Elizabeth Truss, did indicate that the new discount rate might not remain at that level forever, and it was announced that there would be another consultation before Easter 2017. She stated:

‘The Government will review the framework under which I have set the rate today to ensure that it remains fit for purpose in the future. I will bring forward a consultation before Easter that will consider options for reform including: whether the rate should in future be set by an independent body; whether more frequent reviews would improve predictability and certainty for all parties; and whether the methodology - which in effect assumes that claimants would invest only in index-linked gilts - is appropriate for the future. Following the consultation, which will consider whether there is a better or fairer framework for claimants and defendants, the Government will bring forward any necessary legislation at an early stage’.

The response to this consultation, entitled: ‘The Personal Injury Discount Rate – How It Should Be Set In Future’, has now been published and the Lord Chancellor and Justice Secretary, David Lidington, announced this month that:

‘Where they expressed a view, consultees advised that claimants do not invest in very-low risk portfolios such as one entirely comprising index-linked gilts and many suggested that it is reasonable to expect claimants to invest in low-risk portfolios instead ... We want to introduce a new framework based on how claimants actually invest, as well as making sure the rate is reviewed fairly and regularly’.[i]

As such, based on the evidence gathered during the consultation period, the Government predicted that the discount rate would be increased to between 0-1% under this new approach.

This guide outlines the impact the new discount rate increase will have on quantum in asbestos related mesothelioma claims.

Damages in personal injury claims are designed to provide full compensation to claimants for losses suffered as a result of someone’s wrongful actions - compensation should neither result in a claimant being over or under-compensated.

The Ogden Tables are designed to assist in the calculation of lump sum damages for future losses in personal injury and fatal accident claims - losses such as net earnings, cost of medical treatment, care, and pension loss. Multipliers are applied to the present day value of a future annual loss to produce a lump sum award. Lump sum awards mean that there is accelerated receipt of future losses not yet incurred and so the lump sum must be adjusted to take into account the interest that can be earned on the lump sum before it needs to be spent. This adjustment is made by applying a ‘discount rate’. The discount rate reflects the interest that would be earned on the lump sum payment based on safe investment within Index Linked Government Stock[ii]. The Ogden Tables also take into account mortality risks, and provide discounts for contingencies to try and ensure a claimant is fully compensated - but not over compensated, nor under compensated.

It has long been argued by claimant representatives that the previous discount rate of 2.5% was out of date and did not reflect the substantial reduction in interest from Index Linked Government Stock and so its use resulted in under compensation of claimants.

The converse argument was that claimants do not always invest cautiously in Government Stock and may invest in mixed portfolios, including higher risk investments. Government Stock does not reflect the reality of how claimants actually invest. Therefore, it was argued that the previous rate of 2.5% was still appropriate or alternatively was set too low and resulted in over compensation of claimants.

The discount rate has long been under Government review. There were two MoJ consultations on the issue in 2012[iii] and 2013[iv] to which the Government never responded. Apparently as a result of the threat of legal action against it by APIL, the Government, at the end of last year, said it would announce the results of its review by 31 January 2017 and this was subsequently extended to February 2017 when it was announced that the rate would be reduced to -0.75%.

Insurance industry reaction was one of grave concern, as 15 of the UK’s most notable motor and commercial liability insurers, targeted their attention towards the Chancellor of the Exchequer, Phillip Hammond, hoping that he would form an obstruction to the change. Indeed, shortly after, Hammond confirmed that the government would ‘urgently’ consult on future changes to the rate. Subsequently, Truss announced at the end of March, the launch of a new consultation into how the discount rate is set. The Government received responses from interested parties and has now published its response to the recommendations.

The consultation responses were divided as to the investment risk appetite that should be assumed in the setting of the rate. There was however, the report states, widespread agreement that claimants should be treated as more risk averse than ordinary prudent investors. The report states:

‘It was also clear, taking the responses and the results of other research together, that claimants invest in low risk diversified portfolios not in “very low risk” investments, such as Index Linked Gilts (ILGs) alone’.

The Government also considered the results of research commissioned by the department from the Government Actuary’s Department (GAD) and the British Institute of International and Comparative Law (BIICL) as well as other evidence, including in particular responses to questionnaires issued to members of the Wealth Management Association, the Personal Finance Society and the Association of Professional Financial Advisers about the investments that personal injury claimants would be advised to make.

Based on these findings, the Government has predicted that the new rate will be between 0-1%. The Lord Chancellor has outlined that a new framework will also be introduced ensuring that the rate is reviewed fairly and regularly.

The first review will be scheduled within 90 days of the new legislation coming into force, requiring the consultation of the Lord Chancellor, the Government Actuary and HM Treasury. In future, the process will be overseen by an independent expert panel, chaired by the Government Actuary, who will be on hand to assist the Lord Chancellor. It is proposed that this would take place at least every three years.

The discount rate is set by the Lord Chancellor under powers provided by s.1 of the Damages Act 1996 (as amended). The Statutory Instrument, entitled, The Damages (Personal Injury) Order 2017 formally amended the rate of return in section 1(1) of the Damages Act 1996 to -0.75% and a new Statutory Instrument will be introduced when the new rate is determined.

First, the new rate will be proposed in draft legislation with Ministers expected to discuss the issue before a formal Bill is introduced into Parliament. The Government has invited comments on the draft legislation from interested parties. Once enacted the changes will be brought into force on a date to be specified by the Lord Chancellor.

The response to the consultation can be accessed here.

IMPACT ON MESOTHELIOMA CLAIMS

How will the potential options for the new Ogden discount rate impact on quantum in mesothelioma claims?

We look at a worked example below and provide a Fatal Damages Calculator and a simple quantum ready reckoner table to allow you to carry out your own quantum assessments of the different potential discount rates across different ages.

Example: Fatal mesothelioma claim 70 year old deceased male

Let us take as an example a male who dies from asbestos related mesothelioma at age 70. The medical evidence is that the deceased had a normal life expectancy and would have lived for just over a further 17 years to age 87 but for the mesothelioma. He was married and a claim is pursued by his widow on behalf of the estate and as a dependent. She was aged 60 at the time of death and has a normal life expectancy to age 88. She would therefore have outlived the deceased in any event. Her dependency upon the deceased would have come to an end on his death when he reached 87.

The widow’s dependency on the deceased’s pension is valued at £10,000 p.a.

There is also a dependency claim on services valued at £1,500 p.a. which would have existed for 10 years up to the deceased reaching age 80.

An assessment of damages takes place 3 years after death - so the deceased’s assumed age is 73.

Applying the previous 2.5% discount rate, the value of the claim is £276,478 based on the heads of loss shown in the table below-see edition 168 of BC Disease News for the full calculation. Applying the -0.75% discount rate the claim is valued at just over £308,000 (ignoring interest) - an increase of £31,844 or 11.5% of the current value. In the example below the valuation for this claim is also provided based on 0%, 0.5% and 1%.

The only affected heads of loss are for dependency on pension and for dependency on services. The other heads of loss valued at £117,980 (or 43% of the claim overall) remain unaffected.

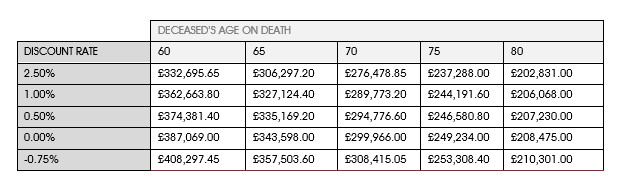

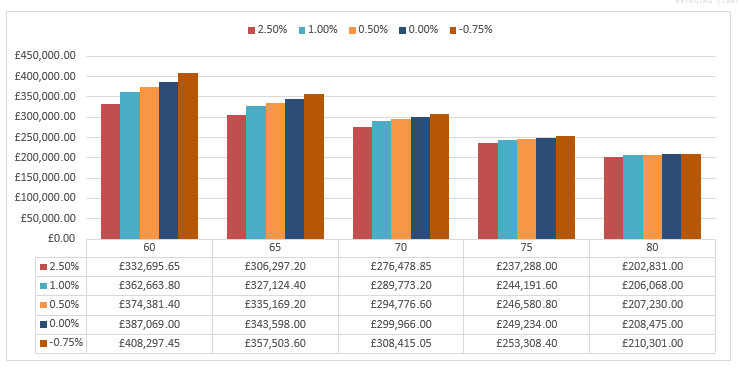

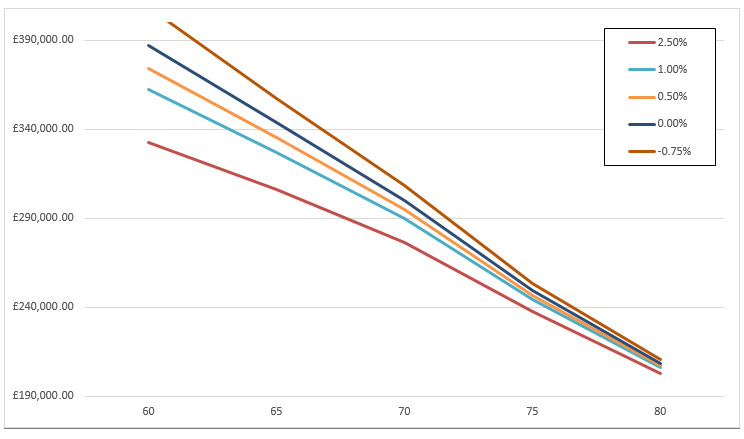

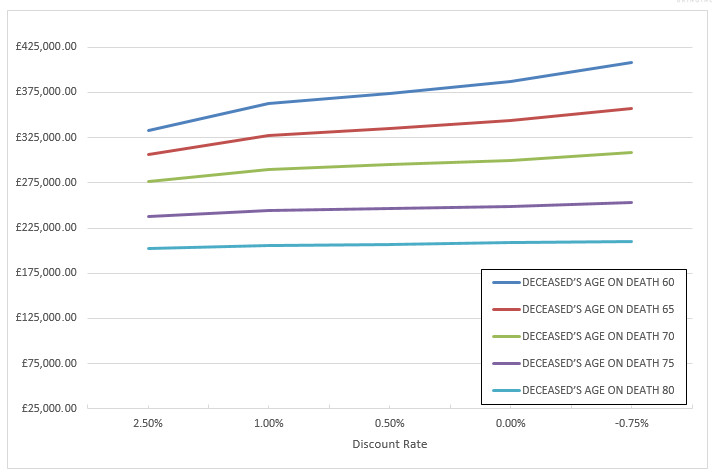

Based on the same set of facts as our example above, but applying different ages for the deceased at death (5 year brackets between ages 60-80), we set out in the table below, the impact the potential new discount rates will have on the overall cost of such a claim, compared to the old 2.5% discount rate and the current -0.75% discount rate.

These changes are also represented in the figures below.

Mesothelioma fatal damages tool

The HSE has reported that the majority of mesothelioma deaths in recent years has been in those aged 75-80[v]. Most fatal mesothelioma claims arise when the deceased is retired. Ogden Table 28 multipliers are typically used with the ‘but for’ life expectancy or duration of services dependency based on medical evidence and taken as term certain[vi]. For a full explanation of the methodology for assessment of damages in fatal claims please see editions 130 of BC Disease News here.

Our mesothelioma fatal damages tool can be used to carry out your own assessments of quantum in relatively straightforward cases applying the new discount rate. Just enter some brief factual details of the claim, your financial and services multiplicands and the tool will do the rest.

If you would like access to this tool, please email This email address is being protected from spambots. You need JavaScript enabled to view it..

IMPACT ON THE INSURANCE INDUSTRY

As we have already mentioned, the -0.75% discount rate came as a surprise to many who predicted that the rate would be reduced from its previous 2.5% but would remain positive.

Reaction thus far to the latest discount rate change has been mostly positive, with Huw Evans, Director General of the Association of British Insurers (ABI) welcoming ‘a sound basis for setting the rate in the future’ and said the new rate ‘would better reflect how claimants actually invest their compensation in reality’.

Further, FTSE 100 company, Direct Line, has seen its share price rise by 4% since the latest news surfaced, although their interim profits, published last month, demonstrated that the impacts of the (-)0.75% discount rate had been less severe than feared, in any event.[vii]

LV= pledged to pass the savings on in full. Steve Treloar, managing director of general insurance at the firm, said: 'The new system will not only ensure fair payments for those making claims but it will also help reduce the cost of car insurance for drivers at a time when premiums are at record highs for hard pressed motorists. LV= commits to passing on 100 per cent of the savings produced by this legislation.'

Stephen Hester, chief executive at RSA Group, added: 'If passed, the benefits will be felt by all our customers, helping to stop the rot of steep rises in premiums.'

Colm Holmes, chief executive of Aviva's UK general insurance business, said: 'This is good news for our customers, as any measures which reduce the rising costs of insurance will directly feed through to premiums.'

Simon McCulloch, director at comparethemarket.com, said if the discount rate were set at 0.5 per cent it would reduce the average car insurance premium by around £23.

'We should bear in mind, however, that the original changes to the rate in February this year added around £60 to motor insurance costs, so drivers are still paying more than they were last year as a result of the reforms,' he added.

'Whilst any changes which reduce costs will be welcomed by motorists, they should be seen in the context of a worryingly steep upward curve for car insurance driven by other factors too, such as the recent hikes in insurance premium tax.' [viii]

On the claimant side, Brett Dixon, president of the Association of Personal Injury Lawyers, said the new rate ‘must be set to meet the needs of catastrophically injured people’, adding that lower insurance premiums were ‘of no benefit if (customers) are severely injured and forced to take risks with the compensation they so desperately need’.

We await a full draft of the Bill in due course and no doubt there will be further reaction once the final rate is set.

[i] Neil Rose, ‘Government unveils new basis for setting discount rate’ (7 September 2017 Litigation Futures) <http://www.litigationfutures.com/news/government-unveils-new-basis-setting-discount-rate> accessed 7 September 2017.

[ii] These are Government bonds issued to finance its borrowing requirements and considered to be among the safest assets to hold. The Government sell bonds with a promise that they will pay back the money invested at a future date at an agreed rate of interest. These bonds can also be linked to the Retail Price Index (RPI) and payments adjusted in line with changes in the RPI.

[iii] Damages Act 1996: The Discount Rate-How should it be set? Consultation Paper CP 12/2012 (consultation started 01.08.2012 and ended 23.10.2012)

[iv] Damages Act 1996: The Discount Rate-Review of the Legal Framework. Consultation Paper CP 3/2103 (started 12.2.2013 and ended 7.5.2013)

[v] Health and Safety Executive, ‘Mesothelioma Statistics, http://www.hse.gov.uk/statistics/causdis/mesothelioma/mesothelioma.pdf?pdf=mesothelioma

[vi] See Knauer v Ministry of Justice [2016] UKSC9

[vii] ‘Insurers toast new discount rate plans’ (7 September 2017 Law Society Gazette) <https://www.lawgazette.co.uk/law/moj-reveals-potential-new-discount-rate-/5062678.article> accessed 7 September 2017.

[viii] http://www.dailymail.co.uk/news/article-4863944/Car-insurance-going-feared.html