INTRODUCTION

In this week’s feature article, we review the Government’s decision to raise the Ogden rate, otherwise known as the personal injury discount rate (PIDR), from (-)0.75% to (-)0.25%, commencing 5 August 2019.

WHAT IS THE OGDEN RATE AND HOW IS IT CALCULATED?

Damages in personal injury claims are intended to provide full compensation to claimants for losses suffered as a result of someone’s wrongful actions – compensation should neither result in under-, nor over-compensation.

The Ogden Tables are designed to assist with the calculation of lump sum damages for future losses, costs and expenses in personal injury and fatal accident claims by returning claimants to the same financial position had they not been injured. This includes:

- Loss of earnings;

- Loss of pension.

- The costs of medical treatment; and

- Care costs.

To derive an appropriate lump sum award, i.e. damages that will sufficiently compensate a claimant into the future, multipliers, sourced in the Ogden Tables, are applied to the present day value of a defined/undefined term of annual losses.

Settling by way of a lump sum provides the claimant with accelerated receipt of damages, while also providing fiscal certainty for insurers.

The purpose of the PIDR is to adjust the multipliers, on the assumption that claimants will invest their damages and incur tax, expenses (investment management costs) and inflation on returns, as well as ‘wider economic factors’. The effect of the PIDR on a lump sum award is therefore a reflection of what is expected to be accrued or lost before a claimant exhausts their compensation.

THE HISTORY OF SETTING THE DISCOUNT RATE

In England and Wales, the PIDR is set by the Lord Chancellor, pursuant to the Damages Act 1996, as amended.

We reported, in edition 175 of BC Disease News (here), that the then Lord Chancellor, Elizabeth Truss MP, had reduced the PIDR from 2.5% to (-)0.75%, which was formally adopted through the Damages (Personal Injury) Order 2017, taking effect from 20 March 2017.

The rationale behind this substantial reduction was that the 2.5% discount rate (established in 2001) was out of date and did not take into account the fact that claimants were investing in ‘very low risk’ portfolios, such as Index Linked Gilts (ILGs).

The insurance industry, however, immediately lobbied the Government for immediate change, and consultees to the subsequent Government consultation: The Personal Injury Discount Rate – How it should be set in future,[i] suggested that claimants were more likely to invest in ‘low risk’ diversified portfolios than ILGs. In short, there was a risk that claimants would be ‘substantially over-compensated’ under a (-)0.75% PIDR.

Prior to 2018, there were ‘no fixed intervals’ for setting an updated rate of return.

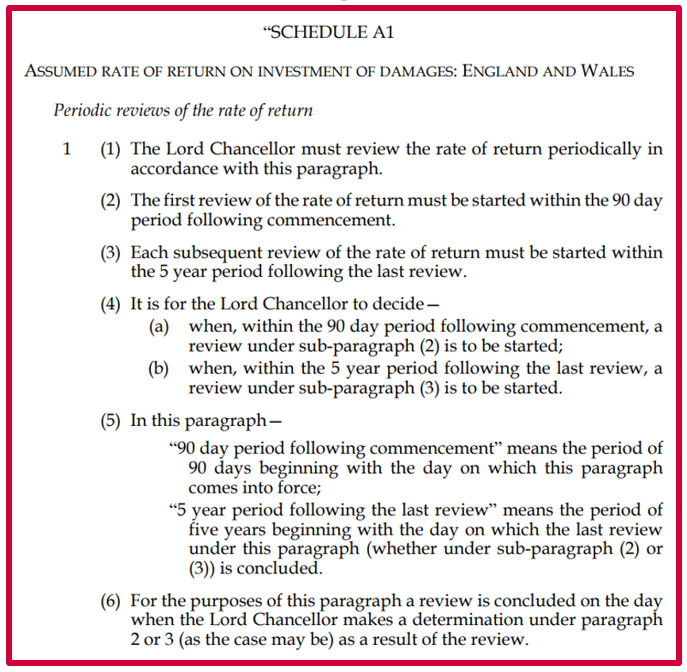

However, in December 2018, the Government passed a regime of reforms in the Civil Liability Act – this was reported in edition 257 (here). Part 2 of the 2018 Act, entitled: Personal Injury Discount Rate, amends the 1996 Act by inserting a structured framework for future periodical reviews of the discount rate within 5-years of the last, with the advice of an expert panel.

THE 2019 REVIEW

The ‘first review’ process was initiated by the current Lord Chancellor, the Rt Hon David Gauke MP, in March 2019, as was reported in edition 267 (here) of BCDN. This meant that the latest date for setting the new rate was 7 August 2019.

Influenced by responses to a Call for Evidence, the MoJ was able to ‘gather up-to-date information on investment rates, returns and other data that will assist in setting a new rate’.

In a material development, last Friday, the London Stock Exchange was made aware of an impending announcement.[ii] Then, on Monday of this week, the Lord Chancellor revealed that, following an ‘extensive review’, the new rate would be (-)0.25%, coming into force on 5 August 2019.[iii]

This increase has shocked the personal injury market, as Mr. Gauke’s predecessor, David Lidington MP, anticipated that the ‘reasonable expectation’ of claimants practising ‘low-risk portfolio’ investment would better suit a PIDR between 0% and 1%.

WHY MINUS 0.25%, IN THE FACE OF GOVERNMENT ACTUARIAL ADVICE?

In conjunction with the Lord Chancellor’s announcement on 15 July 2019, the MoJ published its Impact Assessment, which estimated that insurers will save between £230 million and £320 million per year, as a result of the uplifted PIDR.[iv]

The Civil Liability Act 2018 imposes a statutory duty on insurers to report on the amount of savings generated by discount rate change, along with the extent to which these savings have been passed on to consumers. However, it is unlikely that the figures will be reported before 2024.

In addition, the Lord Chancellor’s full Statement of Reasons for reaching his rate determination was also published.

This made reference to Advice, provided by Government Actuary, Martin Clarke, who actually concluded that setting the rate at 0.25% would result in a 50:50 risk of claimants being under or over-compensated.

In formulating his Advice, the Government Actuary:

- Reviewed the responses from stakeholders as part of the call for evidence, which was issued to gather information relating to matters that may influence the Rate;

- Used this evidence to inform assumptions on claimant characteristics, representative investment portfolios, level of expenses and tax and claimant cost inflation;

- Modelled claimants’ possible future returns using these assumptions and sensitivities;

- Analysed a range of possible outcomes in terms of claimants being compensated for their loss; and

- Provided analysis on the risks emerging from this modelling, to assist the Lord Chancellor in making a decision on the Rate to be introduced.[v]

However, the Rt Hon David Gauke MP, despite accepting the actuarial analysis, stated that 0.25% PIDR ‘would run too high a risk of under-compensating claimants’.

He considered a 50:50 risk of claimants being under or over-compensated to be a ‘starting point rather than an end point’.

He went on to explain why, at paragraphs 17 to 21 of his Statement:

‘I consider that a rate of plus 0.25% would run too high a risk of under-compensating claimants. At this level, the representative claimant as modelled by the Government Actuary has only an approximately 50% chance of being fully compensated and approximately only a 65% chance of receiving 90% compensation. I consider this to give rise to too great a risk that the representative claimant will be undercompensated, or under-compensated by more than 10%.

If I were to set a rate of 0%, the representative claimant as modelled by the Government Actuary would have approximately a 60% chance of receiving full compensation and approximately a 72% chance of receiving at least 90% compensation.

I note that, on the baseline assumptions, at a rate of minus 0.25%, the representative claimant as modelled by the Government Actuary has approximately a two-thirds chance of receiving full compensation and a 78% chance of receiving at least 90% compensation. Such a claimant is approximately twice as likely to be overcompensated as under-compensated and is approximately four times as likely to receive at least 90% compensation as they are to be under-compensated by more than 10%. I consider that this leaves a reasonable additional margin of prudence which reflects the sensitivities of the rate to the baseline assumptions. The impact assessment said that, at the current rate, the ‘median’ claimant could be expected to be over-compensated by around 25% for an award expected to last for 30 years.

... If the rate were set at minus 0.5% then the representative claimant as modelled by the Government Actuary would have approximately a 70% chance of the award not being exhausted at the end of the term and approximately a 20% chance of having more than 10% of the award remaining at the end of the term of the award, and the median expectation is of over compensation of almost 20%. I consider that this gives rise to too great a risk that the award will not be exhausted at the term of the award, or that there may be more than 10% of the award remaining at that time’.

Another proposal, which was not indorsed by the Lord Chancellor, was the Government Actuary’s position on ‘dual rates’. Our readers will be familiar with Jersey’s adoption of such a measure (0.5% discount on the entire settlement, where the single lump sum covers a period of up to 20 years; and 1.8% discount on the entire settlement, where the single lump sum covers a period in excess of 20 years), having read our article in edition 261 of BCDN (here).

The Government Actuary stated that a prospective ‘dual rate’, in England and Wales, would involve a lower short-term rate, followed by a higher long-term rate, after a ‘switchover’ period.

Again, however, Mr. Gauke was circumspect in his Written Statement on this subject:

‘Although I consider their analysis interesting with some promising indications, I do not consider it appropriate, noting the lack of quantity and depth of evidence required, to adopt a dual rate for this review. The potential of the dual rate to be appropriate for future reviews is one that I will consider in more detail’.

IS THE NEW RATE GAUKE’S PARTING GIFT?

It also appears, from the wording of a speech, delivered by Mr. Gauke yesterday, that he will soon be stepping down from his cabinet roll as justice secretary, though this is suspected to have little to do with his Office and more to do with Conservative leadership and ‘Brexit’. Will he, in fact, have the opportunity to consider the ‘dual rate’ in more detail, as claimed?

At a Social Market Foundation event, he came across as non-committal:

‘It is my hope that in the years ahead - whoever has the privilege of being justice secretary - it is an approach that will be pursued with persistence and determination and courage. And that it will help deliver a safer and more civilised society’.[vi]

Mr. Gauke is the 6th Lord Chancellor since 2010 and the only solicitor to have ever held the prestigious position.

IMPACT OF THE NEW OGDEN RATE ON THE PERSONAL INJURY MARKET[vii]

Some insurers have already realised millions in financial gain, having projected that the new rate would fall between 0% and 1%. Hastings Group Holdings and its subsidiaries is the first insurance company to reveal the damage of prematurely releasing reserves in expectancy of a higher discount rate:

‘The company expects this to result in a one-off pre-tax charge to its 2019 financial statements of £8.4m ...’[viii]

More market reaction to the (-)0.25% rate is presented below.

Association of British Insurers (ABI)

Huw Evans, Director-General of the ABI, has denounced the new PIDR as a ‘bad outcome’, on the premise that:

‘A negative rate maintains the fiction that a claimant and their representatives will knowingly choose to invest their damages in a way that would guarantee losing them money’.

By remaining the lowest discount rate in the Western world, he further believes that the UK Government missed an opportunity to boost its ‘attraction to international capital’ by standing out as an ‘outlier’ statistic.

Forum of Insurance Lawyers (FOIL)

Elsewhere, FOIL Member, Tony Cawley, voiced his ‘disappointment’ over the fact that ‘numerous representations made by FOIL and the insurance industry have failed to be taken into consideration’.

LV=

‘At this level we believe that claimants will remain over-compensated’.

This was the opinion of Martin Milliner, General Insurance Claims Director at LV=.

Stressing that the increase in percentage did not go far enough, he does not see an end to the ‘uncertainty’, affecting ‘claimants, lawyers and compensators’, that has been associated with the (-)0.75% PIDR for the past couple of years:

‘... this rate will be surely challenged once again at the next review in five years’ time’.

Zurich

Meanwhile, at Zurich, Chief Claims Officer, David Nichols, echoed the sentiments of many, when he said that he was ‘greatly disappointed’ with the result of the rate review. He warned, in particular, of the adverse ‘financial impact on public liability cover for the public sector and businesses’.

AXA Insurance

What is more, David Williams, Managing Director of Underwriting and Technical Services at AXA, has criticised this as a ‘real missed opportunity’, observing that the new rate is both ‘below the rate insurers have been using for pricing, and below the level most claims have been settling at whilst we awaited the announcement’.

As the Managing Director of personal injury settlement specialist, Frenkel Topping, expounded:

‘The defendant would argue for 1 and the claimant for 0% and the final settlement would typically be somewhere in the middle’.

Allianz Insurance

Not all insurance market players were discouraged with the Lord Chancellor’s announcement, though. General Manager for Commercial and Personal Insurance, Simon McGinn, admitted that, although the new PIDR ‘does not go far enough’, it does represent a ‘move in the right direction’.

Osbornes Law

Ben Posford, Head of the Catastrophic Injury department at claimant firm, Osbornes, thinks that the Lord Chancellor may have resisted pressure from the insurance industry:

‘... given the state of interest rates – which are likely to fall further in the event of a no-deal Brexit in particular ...’

This may have been what Mr. Gauke was eluding to in his official announcement, when citing the ‘wider economic factors’.

Minster Law

Another factor, which could have made the Lord Chancellor more cautious about increasing the PIDR higher, was made by Stuart Hanley, Deputy Head of claimant firm Minster Law:

‘The revised rate also mirrors the likely outcome of the Damages Act in Scotland, where we understand the Scottish government is due to confirm a -0.25% rate, ensuring there is a level playing field across the UK’.

Thompsons Solicitors

As an alternative to lump sum settlement under a (-)0.25% Ogden rate, Samantha Hemsley, National Head of Serious Injury and Clinical Negligence at claimant solicitors’ practice, Thompsons, has argued that:

‘The real answer is for insurers to use PPOs in settlements as that would make the level of the discount rate irrelevant’.

The downside of periodical payment orders, aside from the ‘Brexit’ conundrum, is that they are not conclusive, where lump sum settlements are. Insurers will have to balance finality against value for money as claimants will continue to seek PPO’s in cases where flexibility is required, e.g. in mesothelioma claims, where private medical treatments are ever-advancing.

IMPACT ON MESOTHELIOMA CLAIMS

How will the new (-)0.25% Ogden discount rate impact on quantum in mesothelioma claims?

Earlier in this edition, we published the latest Health & Safety Executive (HSE) figures on mesothelioma mortality. The report reiterated that the majority of mesothelioma deaths occur in those above the age of 75, when the deceased is retired.

With that in mind, in this section of the feature, we consider the impact of the new PIDR on quantum with a step-by-step worked example of a fatal asbestos-related mesothelioma claim.

Example: Fatal Mesothelioma Claim (70-Year-Old Deceased Male)

A male victim of asbestos-related mesothelioma dies, aged 70.

The medical evidence dictates that the deceased had a normal life expectancy and would have continued to live for a further 17 years, but for his condition, i.e. death of natural causes at 87-years-old.

The deceased was married and a claim is pursued by his spouse, on behalf of the estate and as a dependent.

She was 60-years-old at the time of her husband’s death and has a normal life expectancy of 88. She would therefore have outlived the deceased in any event.

Her dependency upon the deceased would have come to an end on his death, when he reached 87-years-old.

The widow’s dependency on the deceased’s pension is valued at £10,000 p.a.

There is also a dependency claim on services, valued at £1,500 p.a., which would have existed for 10-years, up to the deceased reaching the age of 80.

An assessment of damages takes place 3-years after death – so the deceased’s assumed age at trial is 73-years-old.

Applying the previous (-)0.75% discount rate, the value of the claim is £308,322.05, based on the heads of loss in Table A, below.

By contrast, applying a (-)0.25% discount rate [which we have based on interpolated multipliers, in the absence of publication of official Government Actuarial Tables], the total claim value is £302,746.70, £5,575.35 (or 1.8%) lower than under the former discount rate.

Given that the extent of the discount rate increase was expected to be more dramatic, we have also calculated the value of claim on the basis of discount rates between 0% and 1%. At the high end (expected change of 1%), the value of our example claim would have dropped to £289,773, a decrease of £18,549 (or 6%).

Table A:

It is apparent, from Table A, that the only affected heads of loss are for post-trial dependency on pension and services. The other heads of loss claimed under the LRA and valued at £117,980 (or 39% of the claim overall), remain unaffected.

In regards to pre-trial dependency, the Supreme Court, in the case of Knauer v Ministry of Justice [2016] UKSC 9, unanimously held that:

‘... the correct date as at which to assess the multiplier when fixing damages for future loss in claims under the Fatal Accidents Act 1976 should be the date of trial and not the date of death’.

This overturned the existing House of Lords authorities of Cookson v Knowles UKHL 3 and Graham v Dodds [1983] NI 22, on the basis that:

‘Calculating damages for loss of dependency upon the deceased from the date of death, rather than from the date of trial, means that the claimant is suffering a discount for early receipt of the money when in fact that money will not be received until after trial’.

What about the effect of the new rate on deceased victims of other ages?

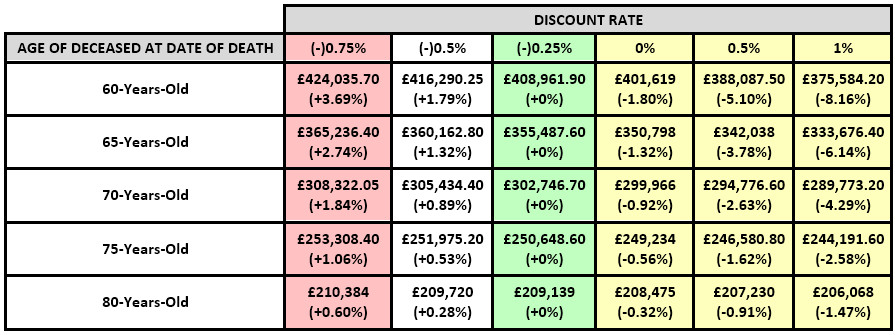

Applying the same set of facts, we can assess the impact of a (-)0.25% discount rate on the overall cost of our example fatal accident claim on deceased mesothelioma victims between the ages of 60 and 80, once again considering also the old (-)0.75% discount rate and the rates that the personal injury market was expecting in the MoJ’s announcement.

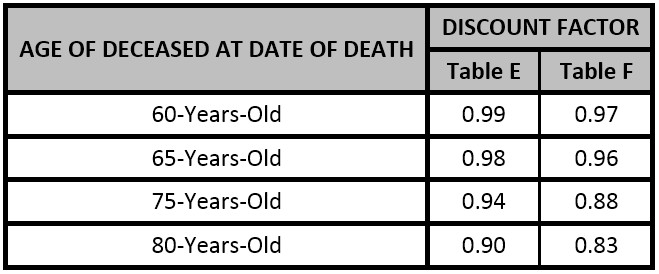

- The Tables E-F discount factors:

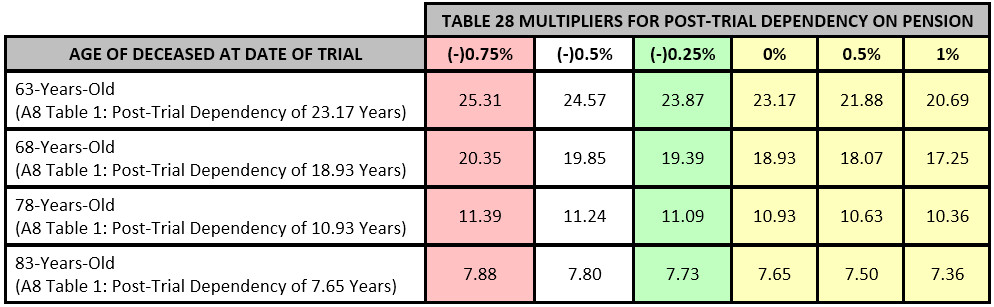

- The Table 28 multipliers for post-trial dependency on pension, as affected by shorter/longer terms (Table 28 multipliers are typically used with the ‘but for’ life expectancy or duration of services dependency based on medical evidence and taken as term certain[ix]):

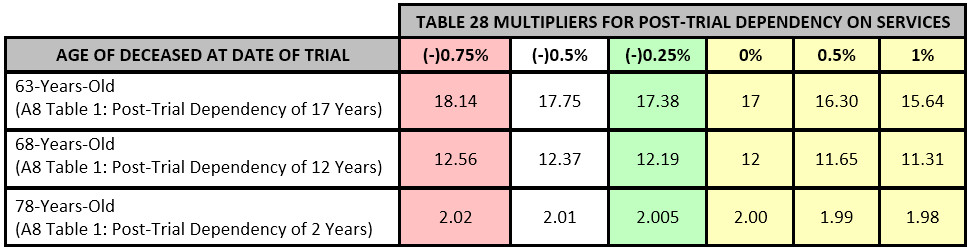

- For all deceased ages, we will assume services would have come to an end at age 80, but for the mesothelioma:

Applying this information, we were able to populate the table below, which clearly shows how the overall value of claim would be affected by mesothelioma victims of varying ages under a wide-range of personal injury discount rates.

Table B:

Amalgamating the figures in Table A and Table B, the full effect of the new discount rate can be acknowledged in Table C.

Table C:

It is easier to comprehend this data when graphically represented – see Bar Chart A and Bar Chart B below.

Bar Chart A:

Bar Chart B:

WHY VALUE CLAIMS MANUALLY?

In February of this year, BC Legal re-launched its innovative quantum and reserving software for personal injury claims, ABCQuantum.

Our tool is able to auto access quantum in all types of claims involving future losses, including fatal accident (such as the example above) and lost years claims.

The new (-)0.25% PIDR has been integrated into ABCQuantum, which is now live and accessible to users.

If you wish to find out more information on how ABCQuantum can help you, please contact Chris McCrudden by telephone / mobile / This email address is being protected from spambots. You need JavaScript enabled to view it..

[i] The MoJ received 40 responses: 13 were from the insurance industry, 14 from law firms, 6 from financial advisers, 3 from the health sector, and 4 from other experts.

[ii] John Hyde, ‘Revealed: Government sets PI discount rate at -0.25%’ (15 July 2019 Law Gazette) <https://www.lawgazette.co.uk/news/revealed-government-sets-pi-discount-rate-at-025/5070996.article> accessed 15 July 2019.

[iii] MoJ, ‘Lord Chancellor announces new discount rate for personal injury claims’ (15 July 2019 GOV.UK) <https://www.gov.uk/government/news/lord-chancellor-announces-new-discount-rate-for-personal-injury-claims> accessed 15 July 2019

[iv] Neil Rose, ‘Discount rate change will save insurers and NHS £400m’ (16 July 2019 Litigation Futures) <https://www.litigationfutures.com/news/discount-rate-change-will-save-insurers-and-nhs-400m> accessed 17 July 2019.

[v] Government Actuary’s Department, ‘The ‘Personal Injury Discount Rate’ – the Government Actuary’s advice to the Lord Chancellor’ (15 July 2019 GOV.UK) https://www.gov.uk/government/news/the-personal-injury-discount-rate-the-government-actuarys-advice-to-the-lord-chancellor> accessed 15 July 2019.

[vi] Monidipa Fouzder, 'Whoever has the privilege': Gauke on the brink of departure’ (18 July 2019 Law Gazette) <https://www.lawgazette.co.uk/news/whoever-has-the-privilege-gauke-on-the-brink-of-departure/5071043.article> accessed 18 July 2019.

[vii] ‘Gauke sets new discount rate at -0.25%’ (15 July 2019 Litigation Futures) <https://www.litigationfutures.com/news/gauke-sets-new-discount-rate-at-0-25> accessed 15 July 2019.

‘New discount rate should reduce ‘barriers to justice for seriously injured people’ says Hudgell Solicitors chief executive Amanda Stevens’ (15 July 2019 Legal Futures) https://www.legalfutures.co.uk/associate-news/new-discount-rate-should-reduce-barriers-to-justice-for-seriously-injured-people-says-hudgell-solicitors-chief-executive-amanda-stevens> accessed 15 July 2019.

Sebastian McCarthy, ‘Insurers voice disappointment as UK changes personal injury discount rate’ (15 July 2019 City.AM) <https://www.cityam.com/personal-injury-insurance-discount-rate-reset/> accessed 15 July 2019.

Ida Axling, ‘Insurers disappointed by the new discount rate’ (15 July 2019 Insurance Age) <https://www.insuranceage.co.uk/insurer/4098281/insurers-disappointed-by-the-new-discount-rate> accessed 15 July 2019.

Mark Dugdale, ‘More reaction to discount rate change’ (16 July 2019 Claims Magazine) <http://www.claimsmag.co.uk/2019/07/more-reaction-to-discount-rate-change/14634> accessed 16 July 2019.

[viii] Neil Rose, ‘Discount rate change means £8.4m hit, says insurer’ (17 July 2019 Litigation Futures) <https://www.litigationfutures.com/news/discount-rate-change-means-8-4m-hit-says-insurer> accessed 18 July 2019.

[ix] Government Actuary’s Department, ‘Actuarial Tables With explanatory notes for use in Personal Injury and Fatal Accident Cases (6th Edition)’ (2007 GOV.UK) <https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/309973/Ogden_Tables_6th_edition.pdf> accessed 18 July 2019.