Damages in personal injury claims are designed to provide full compensation to claimants for losses suffered as a result of someone’s wrongful actions - compensation should neither result in a claimant being over or under-compensated.

The Ogden Tables are designed to assist in the calculation of lump sum damages for future losses in personal injury and fatal accident claims - losses such as net earnings, cost of medical treatment, care, and pension loss. Multipliers are applied to the present day value of a future annual loss to produce a lump sum award. Lump sum awards mean that there is accelerated receipt of future losses not yet incurred and so the lump sum must be adjusted to take into account the interest that can be earned on the lump sum before it needs to be spent. This adjustment is made by applying a ‘discount rate’. The discount rate reflects the interest that would be earned on the lump sum payment based on safe investment within Index Linked Government Stock[i]. The Ogden Tables also take into account mortality risks, and provide discounts for contingencies to try and ensure a claimant is fully compensated - but not over compensated, nor under compensated. The tables are currently in their 7th edition and set out different multipliers based on different discount rates ranging between - 2.0% to +3.0%.

The discount rate is set by the Lord Chancellor under powers provided by s.1 of the Damages Act 1996 (as amended). The current 2.5% discount rate has been in place in England and Wales since July 2001. The rate represents a rate of return over and above inflation.

It has long been argued by claimant representatives that the current discount rate is out of date and does not reflect the substantial reduction in interest from Index Linked Government Stock and so its use results in under compensation of claimants.

The converse argument is that claimants do not always invest cautiously in Government Stock and may invest in mixed portfolios, including higher risk investments. Government Stock does not reflect the reality of how claimants actually invest. Therefore it is argued that the current rate of 2.5% is still appropriate or alternatively is set too low and results in over compensation of claimants.

The discount rate has long been under Government review. There were two MoJ consultations on the issue in 2012[ii] and 2013[iii] to which the Government never responded. Apparently as a result of the threat of legal action against it by APIL, the Government last week said it will announce the results of its review by 31 January 2017 - although any change in the rate will require legislative implementation via s. 1 of the Damages Act.

Applying different discount rates can have a significant impact on the lump sum awards made. The 2013 MoJ consultation provided the following example of an ongoing future loss of £50,000 p.a. for a male for life. A 10 year old claimant would be awarded £1.7m if the discount rate were 2.5% compared to £3.2m if the rate were 0.5%. A 60 year old claimant would be awarded £0.9m under a 2.5% rate compared to £1.2m under a 0.5% rate. The following chart is reproduced from the 2013 MoJ Consultation (page 8).

SO WHAT MIGHT A NEW DISCOUNT RATE BE SET AT?

There has been some judicial insight. In Simon v Helmot[iv] [2012], a Guernsey case to which the Damages Act did not apply, differential discount rates were set-at 0.5% for non-earnings related losses and 1.5% for earnings-related losses. In Thomson v Thompson [2015][v], in a judgment given in the Bermuda Supreme Court but with the claimant living in the UK, it was decided, having heard evidence from an actuary, that the appropriate discount rate in the UK for future losses was -0.5% for heads of damage likely to be affected by price inflation and -2.5% for heads of damage likely to be affected by real earnings increases-i.e. future loss of earnings.

We predict one of 3 outcomes-the rate will remain the same, or it will go down or it will go up! Whatever happens it is hoped that a single discount rate will remain rather than several different rates depending on the head of loss considered.

The Government as compensator for bodies such as the NHS will understandably be reluctant to reduce the discount rate.

IMPACT ON MESOTHELIOMA CLAIMS

How will a changed Ogden discount rate impact on quantum in mesothelioma claims?

We look at a worked example below and provide a Fatal Damages Calculator and a simple quantum ready reckoner table to allow you to carry out your own quantum assessments applying different discount rates.

Example of a fatal mesothelioma claim 70 year old deceased male

Let us take as an example a male who dies from asbestos related mesothelioma at age 70. The medical evidence is that the deceased had a normal life expectancy and would have lived for a further 17 years to age 87 but for the mesothelioma. He was married and a claim is pursued by his widow on behalf of the estate and as a dependent. She was aged 60 at the time of death and has a normal life expectancy to age 88. She would therefore have outlived the deceased in any event. Her dependency upon the deceased would have come to an end on his death when he reached 87.

The widow’s dependency on the deceased’s pension is valued at £10,000 p.a.

There is also a dependency claim on services valued at £1,500 p.a. which would have existed for 10 years up to the deceased reaching age 80.

An assessment of damages takes place 3 years after death - so the deceased’s assumed age is 73.

The claim is valued at just under £277,000 (ignoring interest) based on the following heads of loss:

|

HEAD OF LOSS |

VALUATION |

|

Law Reform Act Claim |

|

|

General Damages (PSLA) |

£75,000 |

|

Bereavement Award |

£12,980 |

|

Care |

£15,000 |

|

Funeral expenses |

£4,000 |

|

Miscellaneous-medication, travel, appliances and adaptions to home, additional costs of food & heating etc. |

£6,000 |

|

Loss of Spouse |

£5,000 |

|

FAA Claim |

|

|

Dependency on Pension |

Pre-trial dependency ( 3 years) 3 years x £10,000 x 0.97 Table E discount factor=£29,100 Post-trial dependency (14.9 years) Ogden Table 28 multiplier 12.48 x £10,000 x 0.93 Table F discount factor=£116,064

Total pension dependency=£29,100+£112,320=£145,164 |

|

Possible Dependency on Services |

Pre-trial dependency ( 3 years) 3 years x £1,500 x 0.97 Table E discount factor=£4,365 Post-trial dependency (7 years) Ogden Table 28 multiplier 6.43 x £1,500 x 0.93 Table F discount factor=£8,969

Total services dependency=£13,334 |

|

TOTAL |

£276,478 |

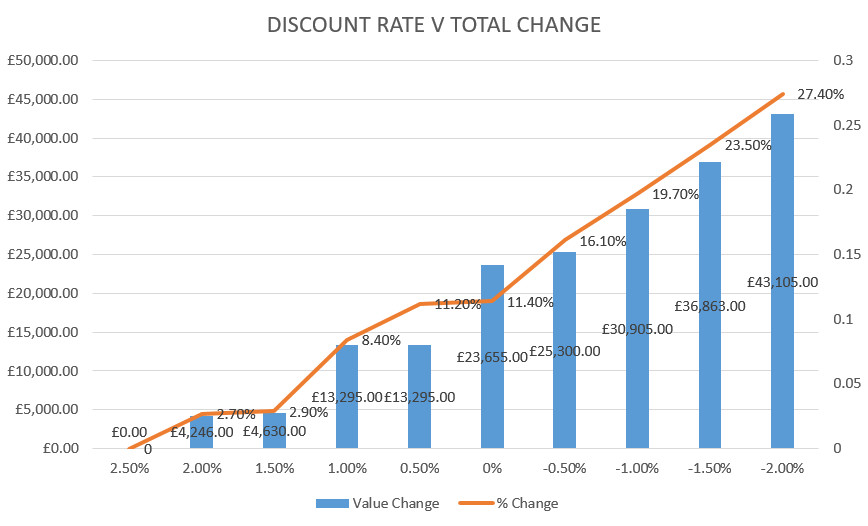

How would this valuation change based on differing discount rates? The only affected heads of loss are for dependency on pension - currently valued at £145,164 - and for dependency on services -currently value at £13,334. The other heads of loss valued at £117,980 (or 43% of the claim overall) remain unaffected.

We show the changes according to different discount rates in the table and figure below:

|

DISCOUNT RATE |

PENSION DEPENDENCY |

CHANGE (£ / %) |

SERVICES DEPENDENCY |

CHANGE (£ / %) |

TOTAL |

TOTAL CHANGE (£ / %) |

|

3.0% |

£141,351 |

-£3,813 / 2.6% |

£13,181 |

-£153 / |

£154,532 |

-£3,966 / 2.5% |

|

2.5% |

£145,164 |

- |

£13,334 |

- |

£158,498 |

- |

|

2.0% |

£149,256 |

+£4,092/ 2.8% |

£13,488 |

+£154 / 1.1% |

£162,744 |

+£4,246 / 2.7% |

|

1.5% |

£149,460 |

+£4,296 / 3.0% |

£13,641 |

+£307 / 2.3% |

£163,101 |

+£4,603 / 2.9% |

|

1.0% |

£157,998 |

+£12,834 / 8.8% |

£13,795 |

+£461 / 3.4% |

£171,793 |

+£13,295 / 8.4% |

|

0.5% |

£162,834 |

+£17,670 / 12.2% |

£14,130 |

+£796/ 6.0% |

£176,964 |

+£13,295 / 11.2% |

|

0% |

£167,856 |

+£22,692 / 15.6% |

£14,297 |

+£963 / 7.2% |

£182,153 |

+£23,655 / 11.4% |

|

-0.5% |

£173,157 |

+£24,368 / 16.9% |

£13,977 |

+£932 / 7.1% |

£182,487 |

+£25,300 / 16.1% |

|

-1.0% |

£178,830 |

£29,798 / 20.6% |

£14,478 |

+£1,107 / 8.5% |

£188,092 |

+£30,905 / 19.7% |

|

-1.5% |

£184,782 |

£35,580 / 24.7% |

£14,660 |

+£1,283 / 9.8% |

£194,050 |

+£36,863 / 23.5% |

|

-2.0% |

£191,013 |

£41,633 / 28.9% |

£14,855 |

+£1,472 / 11.3% |

£200,292 |

+£43,105 / 27.4% |

Mesothelioma fatal damages tool

The HSE has reported that the majority of mesothelioma deaths in recent years has been in those aged 75-80[vi]. Most fatal mesothelioma claims arise when the deceased is retired. Ogden Table 28 multipliers are typically used with the ‘but for’ life expectancy or duration of services dependency based on medical evidence and taken as term certain[vii]. For a full explanation of the methodology for assessment of damages in fatal claims please see editions 130 of BC Disease News here.

Our mesothelioma fatal damages tool below can be used to carry out your own assessments of quantum in relatively straightforward cases applying differing discount rates. Just enter some brief factual details of the claim, your financial and services multiplicands and select your discount rate-the tool will do the rest.

The tool can be accessed here.

Ready Reckoner Table for fatal mesothelioma claims

Based on the same set of facts as our example above, but applying different ages for the deceased at death (5 year brackets between ages 60-80), we set out below a ready reckoner table showing how quantum changes with differing discount rates.

|

DISCOUNT RATE |

DECEASED’S AGE ON DEATH |

||||

|

60 |

65 |

70 |

75 |

80 |

|

|

3.0% |

£324,096 |

£300,090 |

£272,512 |

£240,944 |

£213,670 |

|

2.5% |

£332,695 |

£306,297 |

£276,478 |

£243,201 |

£214,886 |

|

2.0% |

£341,876 |

£312,695 |

£280,724 |

£245,458 |

£216,102 |

|

1.5% |

£351,930 |

£319,766 |

£285,155 |

£247,980 |

£217,318 |

|

1.0% |

£362,663 |

£327,124 |

£289,773 |

£250,510 |

£218,534 |

|

0.5% |

£374,381 |

£335,169 |

£294,776 |

£253,035 |

£219,845 |

|

0.0% |

£387,069 |

£343,598 |

£299, 966 |

£255,834 |

£221,240 |

|

-0.5% |

£400,823 |

£352,602 |

£305,434 |

£258,720 |

£222,634 |

|

-1.0% |

£415,756 |

£362,486 |

£311,288 |

£261,620 |

£224,041 |

|

-1.5% |

£431,950 |

£372,849 |

£317,442 |

£264,783 |

£225,531 |

|

-2.0% |

£449,711 |

£383,994 |

£323,848 |

£267,960 |

£227,033 |

|

AVERAGE +CHANGE £ / % PER 0.5% INCREASE IN RATE |

£13,001 / 3.9% |

£8,633 / 2.8% |

£5,263 / 1.9% |

£2,750 / 1.1% |

£1,349 / 0.6% |

|

RANGE OF CHANGE £ / % |

-£8,599-+£117,016 / -2.6%-+35% |

-£6,207-+£77,697 / -2%-+25% |

-£3,966-+£47,370 / -1.4%-+17% |

-£2,257-+£24,759 / -0.9%-+10% |

-£1216-+£12,147 / 0.6%-+5.7% |

These changes are also represented in the figure below.

Figure: Varying quantum assessments in fatal mesothelioma aged by age and discount rates

More detailed analysis, including how the value of a typical mesothelioma claim changes with each 0.5% change in the discount rate by age and the potential overall range of change, can be found here.

IMPACT ON A BOOK OF ASBESTOS CLAIMS

We have built a simple to use tool to help determine how quantum and reserve requirements might alter across a book of asbestos related mesothelioma and lung cancer claims-living and fatal. For more details please contact This email address is being protected from spambots. You need JavaScript enabled to view it..

[i] These are Government bonds issued to finance its borrowing requirements and considered to be among the safest assets to hold. The Government sell bonds with a promise that they will pay back the money invested at a future date at an agreed rate of interest. These bonds can also be linked to the Retail Price Index (RPI) and payments adjusted in line with changes in the RPI.

[ii] Damages Act 1996: The Discount Rate-How should it be set? Consultation Paper CP 12/2012 (consultation started 01.08.2012 and ended 23.10.2012)

[iii] Damages Act 1996: The Discount Rate-Review of the Legal Framework. Consultation Paper CP 3/2103 (started 12.2.2013 and ended 7.5.2013)

[iv] [2012] UKPC 5

[v] [2015] SC (Bda) 44 Civ (17 July 2015)

[vi] Health and Safety Executive, ‘Mesothelioma Statistics, http://www.hse.gov.uk/statistics/causdis/mesothelioma/mesothelioma.pdf?pdf=mesothelioma

[vii] See Knauer v Ministry of Justice [2016] UKSC9